Upcoming Events

-

South Dade Shoutout: Host Richard Candia talks with Dr. Charles Augustus of Baptist Health and Yordy Rivero of HR Benefits & SDCC Chair-Elect

South Dade Shoutout: Host Richard Candia talks with Dr. Charles Augustus of Baptist Health and Yordy Rivero of HR Benefits & SDCC Chair-Elect | Community Press Releases# (communitynewspapers.com)

-

South Dade Shoutout: Host Richard Candia talks with Karin Mas, SDCC BOD, and Ken Ross, SDCC Chair.

South Dade Shoutout: Host Richard Candia talks with Karin Mas and Ken Ross, SDCC Chair – YouTube

-

SDCC Golf Tournament

Sponsorship Opportunities Available! https://lp.constantcontactpages.com/cu/IkfOyic

-

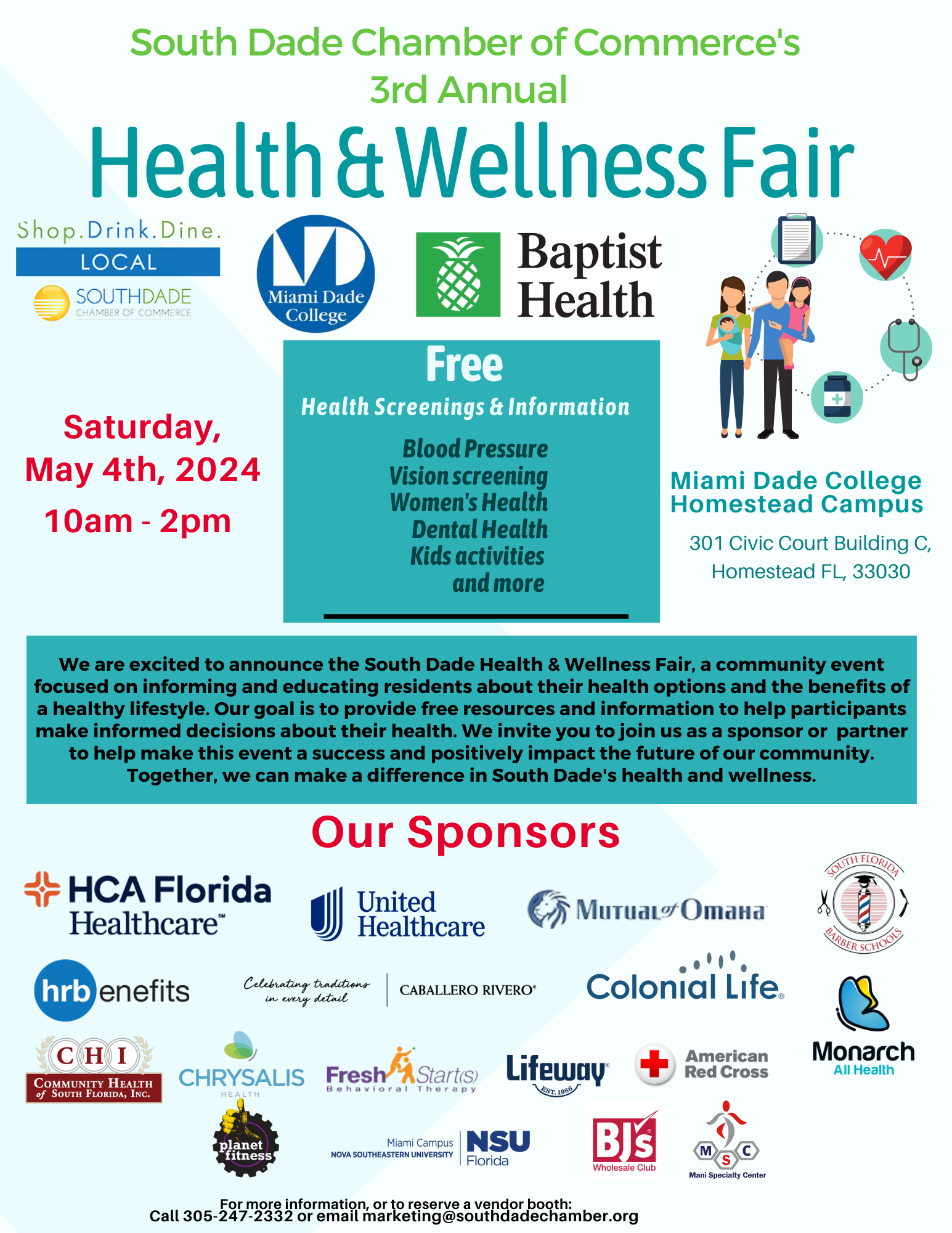

SDCC Health & Wellness Fair

Vendor & Sponsorship Opportunities Available! https://www.eventbrite.com/e/health-wellness-fair-2024-tickets-848563996757